Financial institutions play a decisive role in the transition towards a nature-positive economy. Measuring the biodiversity footprint of investment and lending portfolios enables them to:

- Identify biodiversity-related risks across asset classes and geographies.

- Meet disclosure and compliance requirements under CSRD and TNFD.

- Set science-based targets to reduce biodiversity impacts and dependencies.

- Engage portfolio companies towards improved biodiversity performance.

The Global Biodiversity Score (GBS) provides a robust, science-based methodology to measure these impacts and dependencies enabling financial institutions to turn data into strategic decisions.

This page focuses on the Global Biodiversity Score, our core solution for listed and unlisted assets. For listed assets, we also have co-developed with Carbon4 Finance a dedicated screening database called BIA-GBS (Biodiversity Impact Analytics powered by the Global Biodiversity Score). Contact us to learn more.

Ideal for: Portfolio-wide risk identification, regulatory reporting (e.g., CSRD, LEC 29 in France), or materiality screening.

Key benefits:

-

✔ Fast and cost-effective – Minimal data requirements as it relies on financial and sectoral data, ideal for large portfolios.

-

✔ Regulatory compliance – Meets disclosure needs (e.g., CSRD, Article 29 LEC).

-

✔ Risk prioritisation – Flags high-impact sectors for further action.

Ideal for: Institutions ready to engage issuers, set science-based targets, or design biodiversity-aligned products (e.g., biodiversity funds).

Key benefits:

-

✔ Precision risk management and targeting – Identify biodiversity risks with granularity, identify best-in-class performers within sectors and develop actionable mitigation plans tailored to each asset.

-

✔ Product innovation & credit policies – Support the creation of biodiversity-linked financial products (e.g., biodiversity funds, sustainability-linked loans) and integrate biodiversity into sectoral and credit allocation policies.

-

✔ Issuer engagement & leadership positioning – Co-develop biodiversity strategies with portfolio companies & demonstrate commitment to stakeholders and regulators.

- Data collection: ranging from financial data for the screening to up to 100 physical indicators (e.g., land use, water consumption, pollution, ecosystem fragmentation) from assets or clients for an in-depth assessment

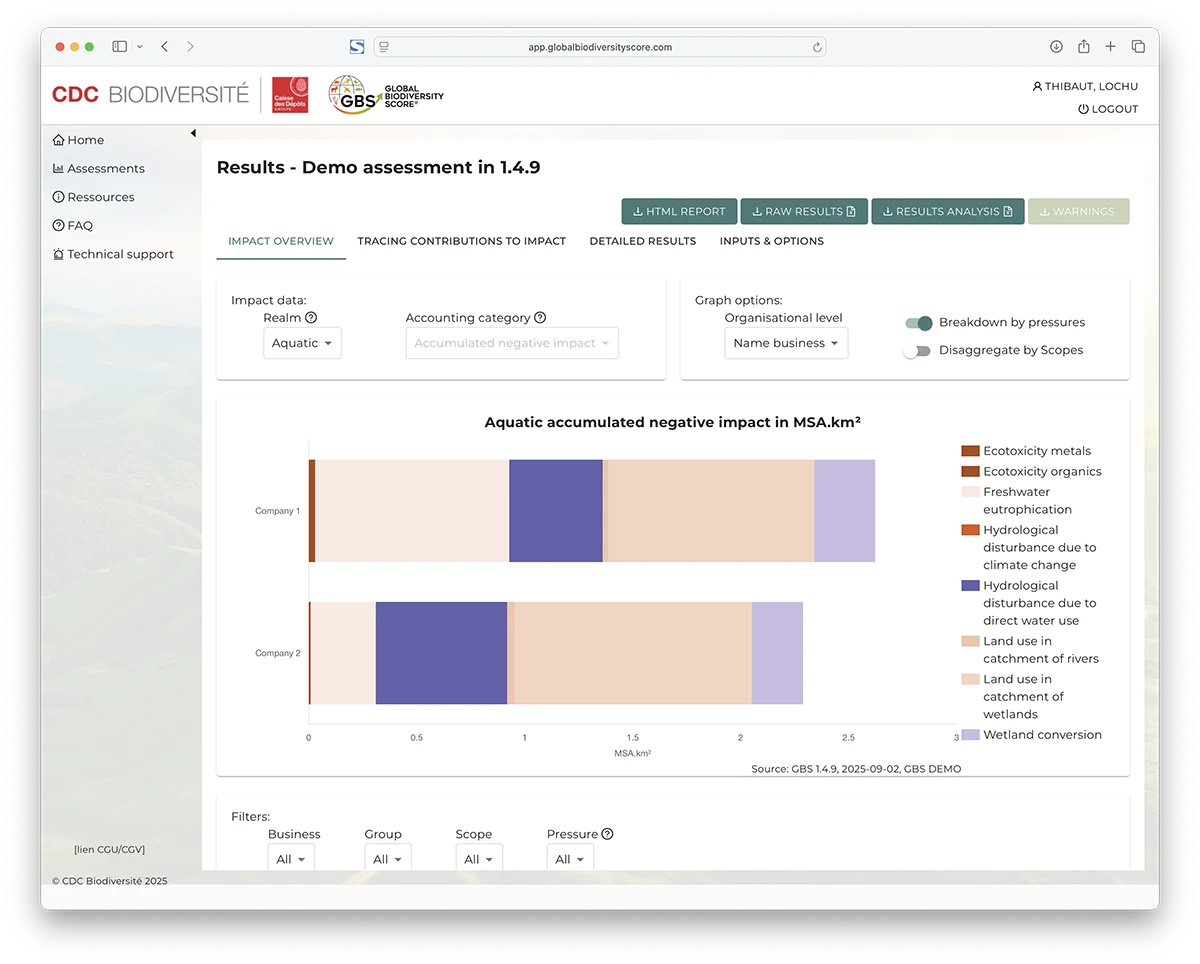

- Pressure assessment: translate portfolio activities into environmental pressures such as land use, climate change, water use, nitrogen deposition, ecosystem fragmentation, and pollution.

- Biodiversity impact calculation: convert pressures into Mean Species Abundance (MSA) values, expressed in MSA·km², to quantify biodiversity loss or gain.

- Result analysis and action: Identify high-impact sectors or geographies, engage with investees and clients, and integrate biodiversity performance into decision-making and reporting.

Portfolio-wide risk mapping – Identify biodiversity hotspots across all asset classes.

Compliance & reporting – Meet CSRD requirement while aligning with voluntary frameworks such as the TNFD.

Science-based target setting – Set and track biodiversity goals with credibility.

Enhanced issuer engagement – Collaborate with portfolio companies on action plans.

Leadership positioning – Demonstrate commitment to stakeholders with transparent reporting.

The GBS doesn’t just measure impacts, it empowers action. Financial institutions use our solutions to:

- Integrate biodiversity into investment policies and risk management frameworks.

- Develop biodiversity-aligned products (g. biodiversity funds).

- Report progress with confidence to investors, regulators, and clients.

By adopting the GBS, your institution can move from compliance to leadership in the global effort to halt biodiversity loss. Contact our team to discuss a tailored solution for your portfolio.

This publication covers methods, use cases, and perspectives for implementing biodiversity footprinting in the financial sector.

This publication covers impact using BIA-GBS, developed by CDC Biodiversité and Carbon4 Finance, with insights into sectoral hotspots, key pressures, and pathways for financial institutions to manage nature-related risks.